Wealth Management for the Future

Hurst Point Group is a wealth management business based in the UK. We aspire to be recognised as a well-respected, leading player in the industry by clients and peers alike. Our shareholder base includes our management team, the former shareholders of the businesses we have acquired, and our lead investor, Carlyle (NASDAQ: CG), one of the world’s leading global investment firms. Together with our debt providers, this makes us one of the best-resourced wealth management groups in the market today.

Established in 2019 to facilitate the acquisition of Harwood Wealth Management Group plc and headquartered in London, we have a further 12 offices around the UK and a team of more than 400 colleagues. Our Group comprises a Jersey-domiciled holding company and two UK-based operating divisions: our Financial Planning division, which is headquartered in Waterlooville, operates primarily under the Argentis brand, whilst our Investment Management division operates primarily under the Hawksmoor brand and is headquartered in Exeter.

Our services

The services we offer include the provision of financial planning advice through circa 100 independent financial advisers and a wide range of investment management solutions, which include: bespoke discretionary services (through a team of approximately 25 highly qualified investment managers); a range of specialist multi-asset funds, which have an excellent long term track record; and a range of model portfolios and unitised funds. We believe that by combining the best of these elements, supported by technology and strong customer service, we can create propositions that will lead to strong client satisfaction, customer engagement and shareholder value over the longer term.

Our strategy

Our strategy first and foremost is to gain the support and trust of our clients through the expert advice we can provide, backed up by excellent service and attractive propositions, which offer fair and transparent pricing. We seek to achieve this by working with expert and engaged colleagues, providing top-quality advice and making our clients our primary focus.

We seek to be an efficient business and invest heavily in technology to improve both our service to clients, as well as the scalability and efficiency of our Group, and to ensure we earn a fair margin for our services. At the same time, we seek to act responsibly, not simply in the way in which we make our investments, but in the way we operate our business, making diversity and inclusion a high priority.

Our corporate goal is to become one of the UK’s leading wealth management businesses, not necessarily in terms of size, but in the quality of the service we provide and the way we run our business. We aim to grow to become a truly national wealth business, establishing both a financial planning and investment management capability in the key conurbations and regions of the UK.

We are working to build a quality, sustainable business on all levels – growing steadily through organic growth, hiring the best talent in the business, and through complementary acquisitions. In the latter case, cultural fit and financial alignment through shared equity participation are among our foremost considerations when considering a prospective investment or acquisition. We look to partner with established management teams, with an inclusive culture, to create a partnership based on a shared vision, an agreed strategy, aligned incentives and an entrepreneurial drive to succeed.

The Development of the Group

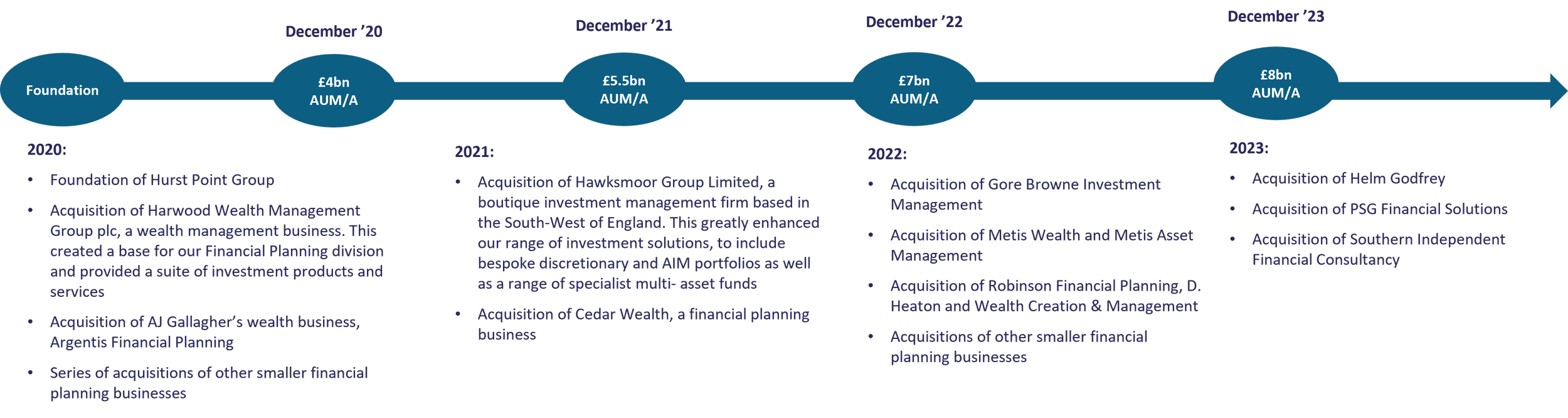

The Group was founded to facilitate our first acquisition, Harwood Wealth Management Group plc in early 2020. This created the base for our Financial Planning division and provided a suite of investment products and services. In late 2020, we completed the acquisition of AJ Gallagher’s wealth business, which traded under the Argentis brand and has now become the main trading brand for our Financial Planning division.

In 2021 we acquired the Hawksmoor Group, providing us with the capability to offer a much wider range of investment products and services. This included bespoke discretionary services and AIM portfolios through Hawksmoor Investment Management and a range of specialist multi-asset funds offered through Hawksmoor Fund Managers. In early 2022, we brought together the Hawksmoor and former Harwood teams, managing model portfolios and other mandates, to form Hawksmoor Investment Solutions. These three business units now form a single Investment Management division. In late 2022, we were able to augment our discretionary capabilities through the acquisition of Gore Browne Investment Management and Metis Asset Management.

In 2022, we expanded our Financial Planning division through numerous complementary acquisitions, including Metis Wealth, D. Heaton, Wealth Creation & Management, and Robinson Financial Solutions.

In 2023 we completed the acquisition of Helm Godfrey, a London-based firm providing specialist financial planning and investment management services, advancing our ambition of becoming a truly national wealth management business with a presence in major cities across the UK.

This acquisition has brought Hurst Point's total AuA to approximately £5bn and its total AuM to approximately £5bn. With c.£2bn of common AuA/M, Hurst Point's net AuA/M is now c.£8bn

Protecting client assets

We make the client’s best interests and security our foremost priority and view this as a key pillar of a sustainable business model.

One important element of our model is that we handle no client money ourselves, entrusting it instead to regulated institutions with both an excellent reputation and a strong capital base; these include third-party investment platforms as well as external custodians. We are primarily a service organisation, providing expertise, advice, and attractive propositions to our clients – helping them to achieve their financial goals, whilst giving them the peace of mind that their financial affairs are in the very best hands.

Enhancing performance.

We believe we can add value to the businesses we partner with through leveraging the skills, knowledge and expertise of both parties. We believe we can achieve more together than either party can achieve on their own. This might be from a variety of sources: from leveraging our strategic insights and operational experience built up over many years; by providing growth capital to facilitate organic investment and bolt-on or transformation M&A activity; by exploiting our knowledge of the capital markets to develop efficient financing options; by designing innovative remuneration schemes that provide effective alignment and incentivisation; or by leveraging our network to attract new partners and high quality talent for the organisation.

Meet the team

Introducing the team that make up our group of companies.

Ian Gladman

Group CEO

Ian Gladman is the Group CEO of the Hurst Point Group, having previously been Managing Director of Hurst Point Capital, its predecessor, which was established in 2019 to work in partnership with Carlyle to identify and develop opportunities for investment into the UK wealth management sector. Ian was previously Group Strategy Director of Old Mutual PLC, as well as a Non-Executive Director of Nedbank and OM Asset Management. This role focussed primarily on developing Old Mutual’s banking, wealth and asset management businesses as well as leading the formulation and execution of the Group’s Managed Separation strategy which was completed in late 2018 with the listings of OM Asset Management, Quilter PLC and Old Mutual Limited as separate entities and the closure of the Head Office. Prior to joining Old Mutual, Ian pursued a career in Investment Banking, with J.P Morgan, Goldman Sachs, and S.G.Warburg which ultimately became UBS Investment Bank, primarily as a coverage officer covering financial services companies and latterly as Co-Head of Financial Institutions EMEA.

Michael Bishop

MD Hawksmoor

Michael has over 20 years’ experience in wealth management, having spent most of his career at UBS where he was head of the bank’s Ultra High Net Worth wealth management business across Northern Europe. He then moved to WH Ireland plc, an AIM-listed business offering broking and wealth management services, where he was Head of Wealth Management. After graduating, Michael worked in the Tax Divisions of Arthur Andersen and PwC. Michael is also a Board Trustee of The Land Trust.

Alan Durrant

Group Investment Director

Alan is Group Chief Investment Officer of Hurst Point Group having previously been Chief Executive Officer of Harwood Wealth Management Group PLC whilst it was listed on London Stock Exchange’s AIM. He was formerly Group CIO of The National Bank of Abu Dhabi and Managing Director of Gulf Finance House. Prior to this he was Chief Investment Manager at Skandia Investment Management and during this time was awarded Financial Adviser’s Multi Manager of the Year three years running. Alan started his investment career at Hargreaves Lansdown, where he was latterly Investment Director.

Andrew Westenberger

Chief Financial Officer

Andrew is a highly experienced CFO with a great deal of knowledge and experience of financial services. Qualifying with Coopers & Lybrand, Andrew spent the next 15 years working in investment banking, including nearly 10 years with Barclays Capital running a large global finance team and acting as COO of their private equity business. He was then appointed Group CFO of Evolution Group plc, which combined equity trading and wealth operations, and then became Group CFO of Brewin Dolphin plc, one of the UK’s leading wealth management businesses. Prior to joining Hurst Point, he was CFO of a PE-backed insurance broking business.

Alex Knott

Chief Transformation and Technology Officer

Alex is Chief Transformation and Technology Officer at Hurst Point Group and brings over 25 years’ experience in Wealth Management. He was formerly CTO at Sanlam UK which followed a long career at Bestinvest and Tilney. Alex developed and led the technology platform at Bestinvest before delivering the integrations and transformation of the business with the acquisitions of Tilney Investment Management and Towry Financial Planning (now Evelyn Partners)

Edward Renwick

Group General Counsel

Edward joined Hurst Point Group in June 2021 as General Counsel. He is an experienced corporate lawyer in both financial services and M&A. Edward has extensive in-house experience having previously worked as Deputy Head of Legal at SG Kleinwort Hambros, the Société Générale group’s private bank and wealth manager. He trained and qualified at City law firm Macfarlanes, with 7 years’ post—qualification experience in Corporate / M&A.